Review the Following Statements and Determine Which Are Correct Regarding an Adjusted Trial Balance

The Aligning Process

23 Fix Financial Statements Using the Adapted Trial Residuum

One time yous accept prepared the adjusted trial balance, you are ready to gear up the financial statements. Preparing financial statements is the 7th step in the accounting bike. Remember that nosotros have 4 financial statements to prepare: an income argument, a statement of retained earnings, a residual canvas, and the statement of cash flows. These financial statements were introduced in Introduction to Financial Statements and Argument of Cash Flows dedicates in-depth discussion to that statement.

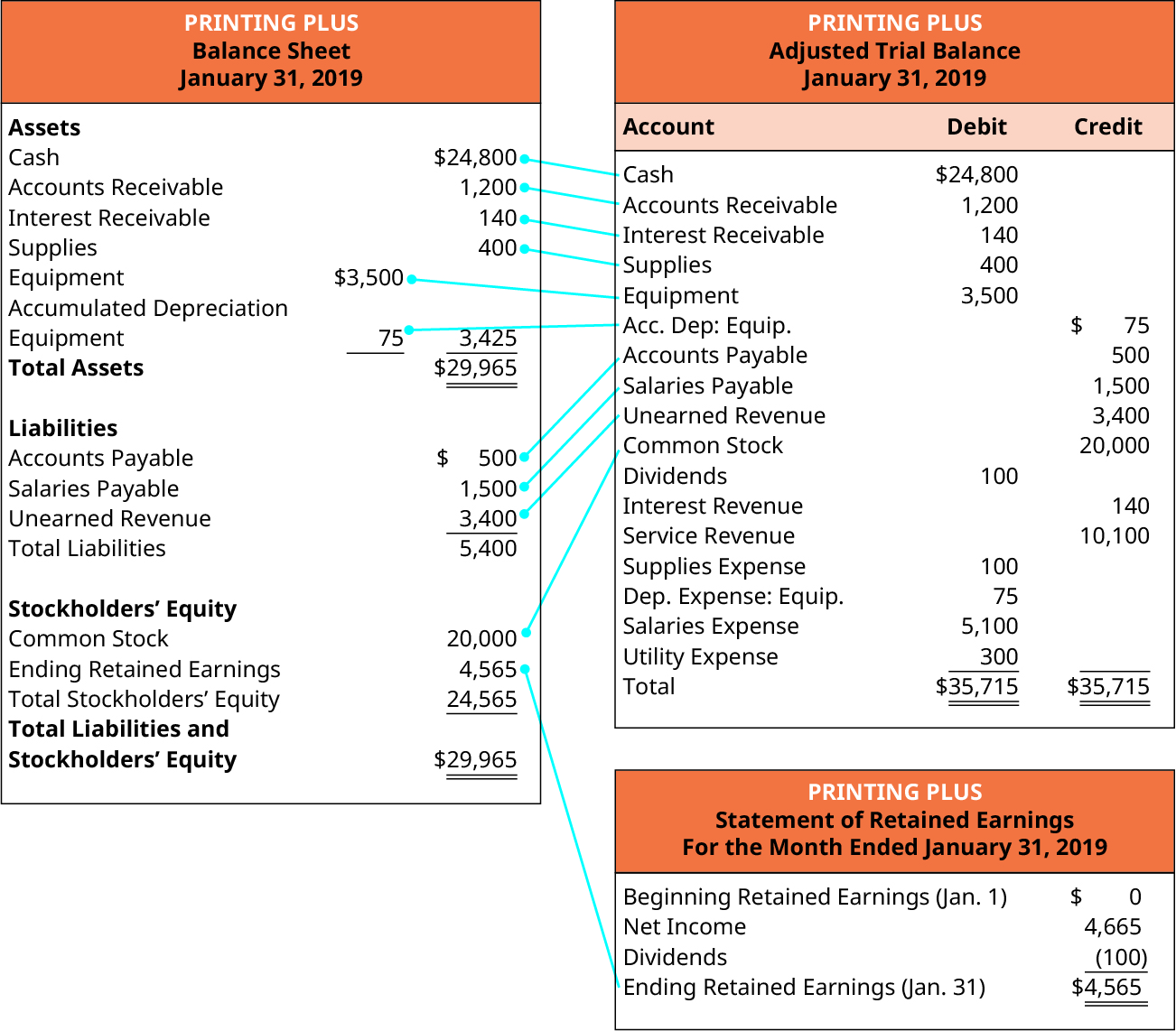

To prepare the financial statements, a company will expect at the adapted trial residue for account information. From this data, the company will begin amalgam each of the statements, beginning with the income argument. Income statements will include all acquirement and expense accounts. The argument of retained earnings will include beginning retained earnings, whatever net income (loss) (institute on the income argument), and dividends. The residual sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock.

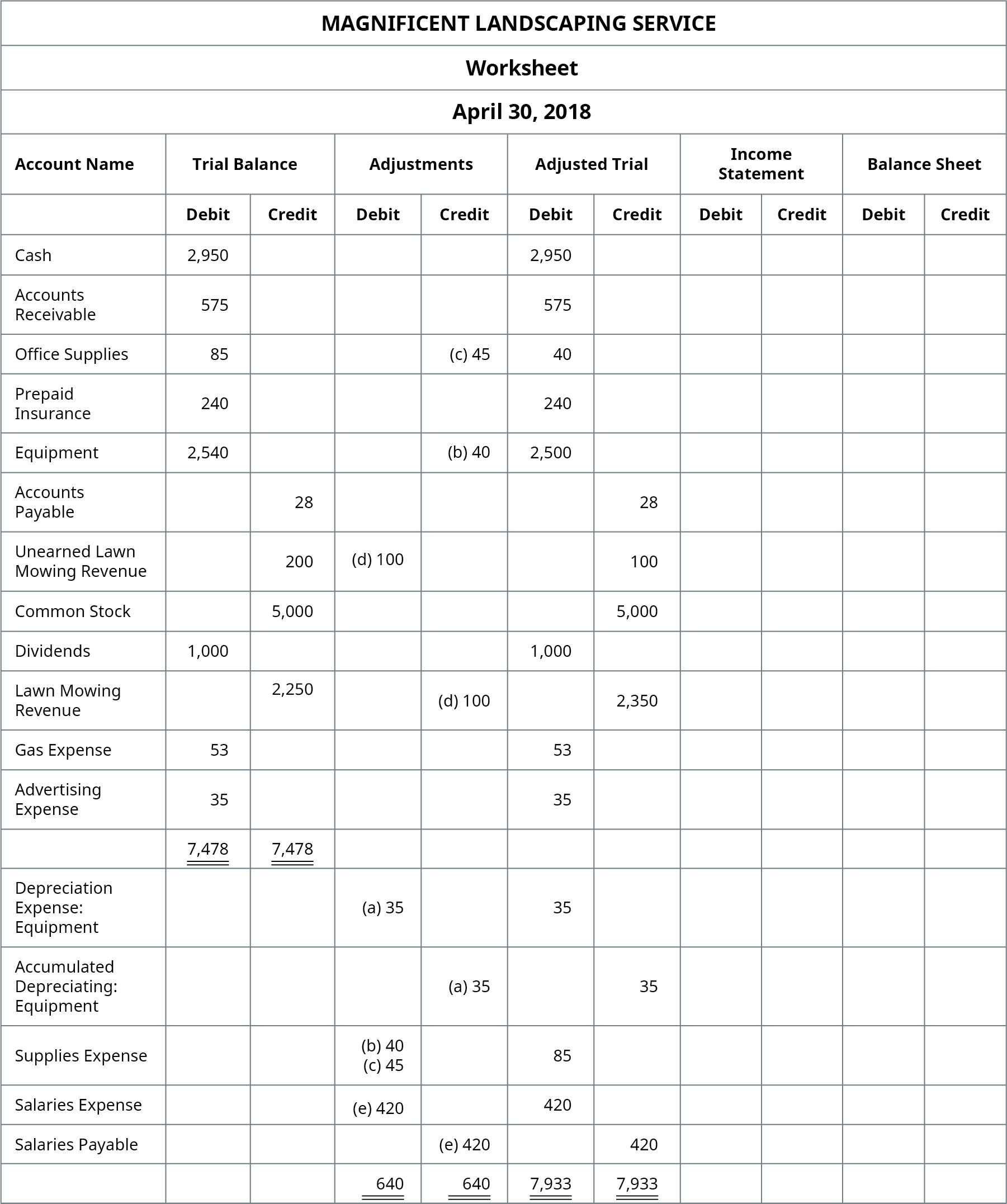

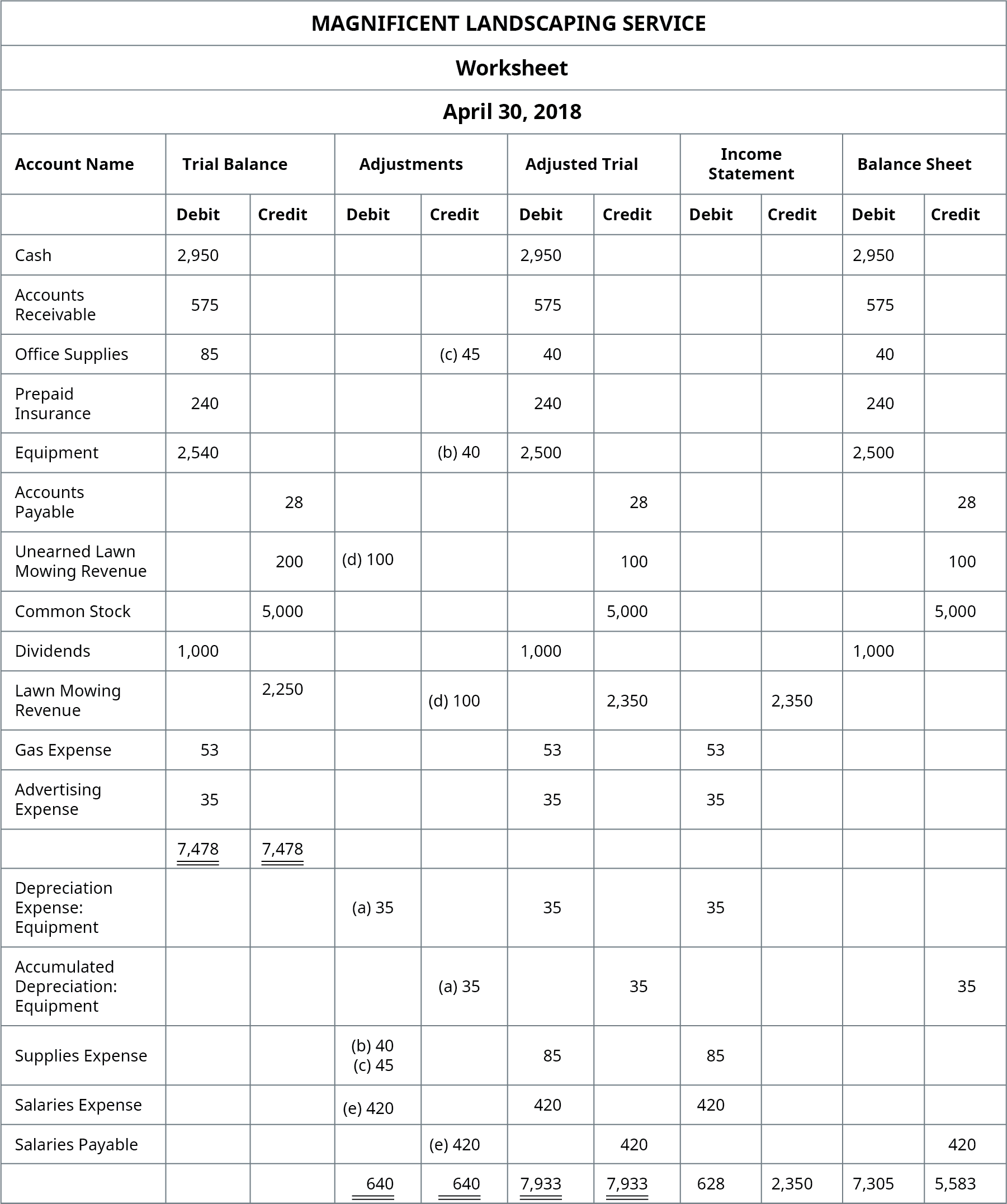

Magnificent Adjusted Trial Residue

Get over the adapted trial balance for Magnificent Landscaping Service. Identify which fiscal statement each account volition become on: Balance Sheet, Statement of Retained Earnings, or Income Statement.

Solution

Balance Sheet: Cash, accounts receivable, role supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned backyard mowing acquirement, and common stock. Statement of Retained Earnings: Dividends. Income Statement: Lawn mowing acquirement, gas expense, advertizing expense, depreciation expense (equipment), supplies expense, and salaries expense.

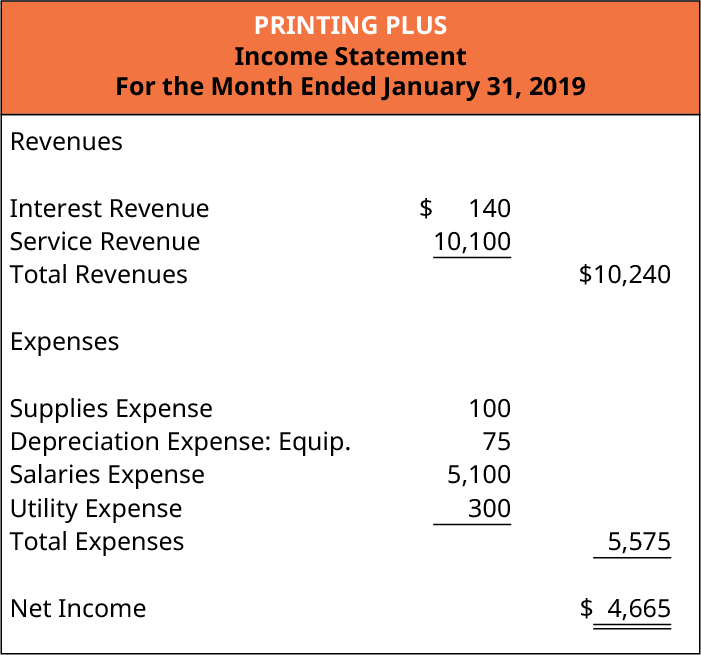

Income Argument

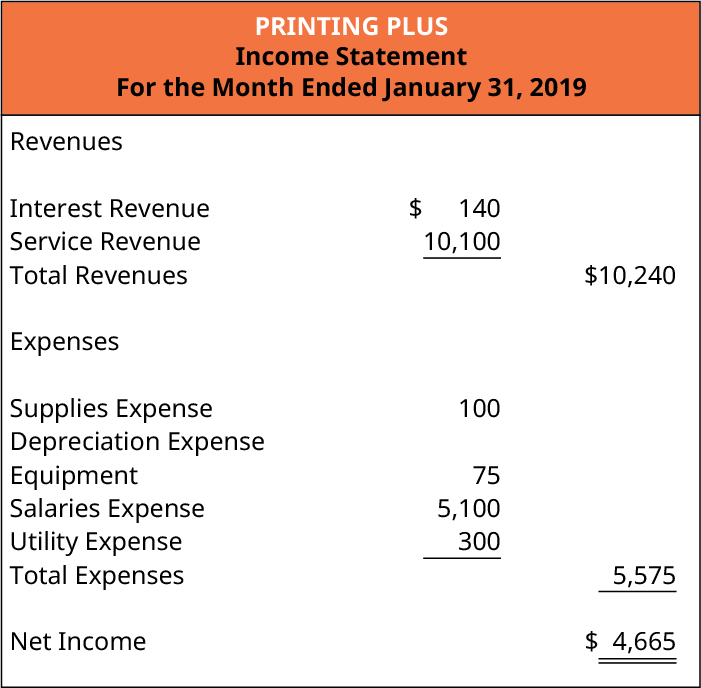

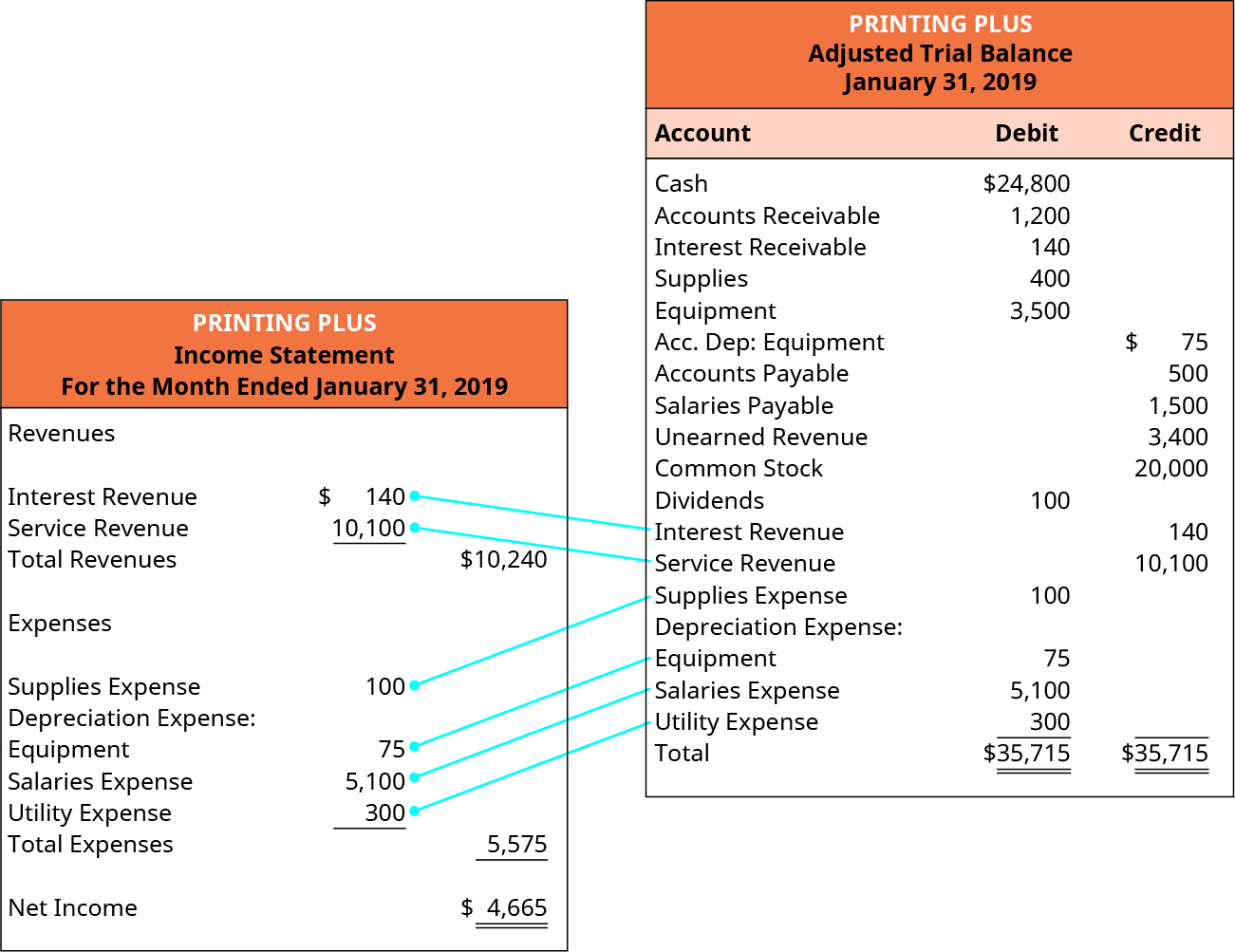

An income statement shows the organization'due south financial performance for a given period of time. When preparing an income statement, revenues will always come before expenses in the presentation. For Printing Plus, the following is its January 2019 Income Argument.

Revenue and expense information is taken from the adjusted trial balance as follows:

Total revenues are $10,240, while total expenses are $5,575. Total expenses are subtracted from total revenues to get a internet income of $4,665. If total expenses were more than total revenues, Printing Plus would have a net loss rather than a net income. This net income figure is used to set up the argument of retained earnings.

The Importance of Accurate Financial Statements

Fiscal statements give a glimpse into the operations of a company, and investors, lenders, owners, and others rely on the accurateness of this information when making future investing, lending, and growth decisions. When one of these statements is inaccurate, the financial implications are great.

For example, Celadon Grouping misreported revenues over the bridge of 3 years and elevated earnings during those years. The total overreported income was approximately $200–$250 million. This gross misreporting misled investors and led to the removal of Celadon Grouping from the New York Stock Commutation. Non simply did this negatively bear on Celadon Group's stock toll and lead to criminal investigations, but investors and lenders were left to wonder what might happen to their investment.

That is why it is so important to go through the detailed accounting process to reduce errors early on and hopefully preclude misinformation from reaching fiscal statements. The business must have stiff internal controls and best practices to ensure the information is presented adequately.1

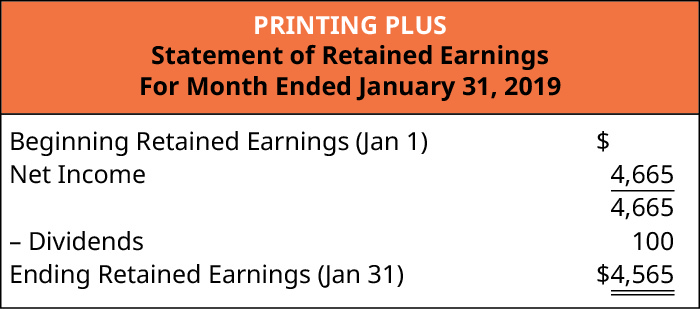

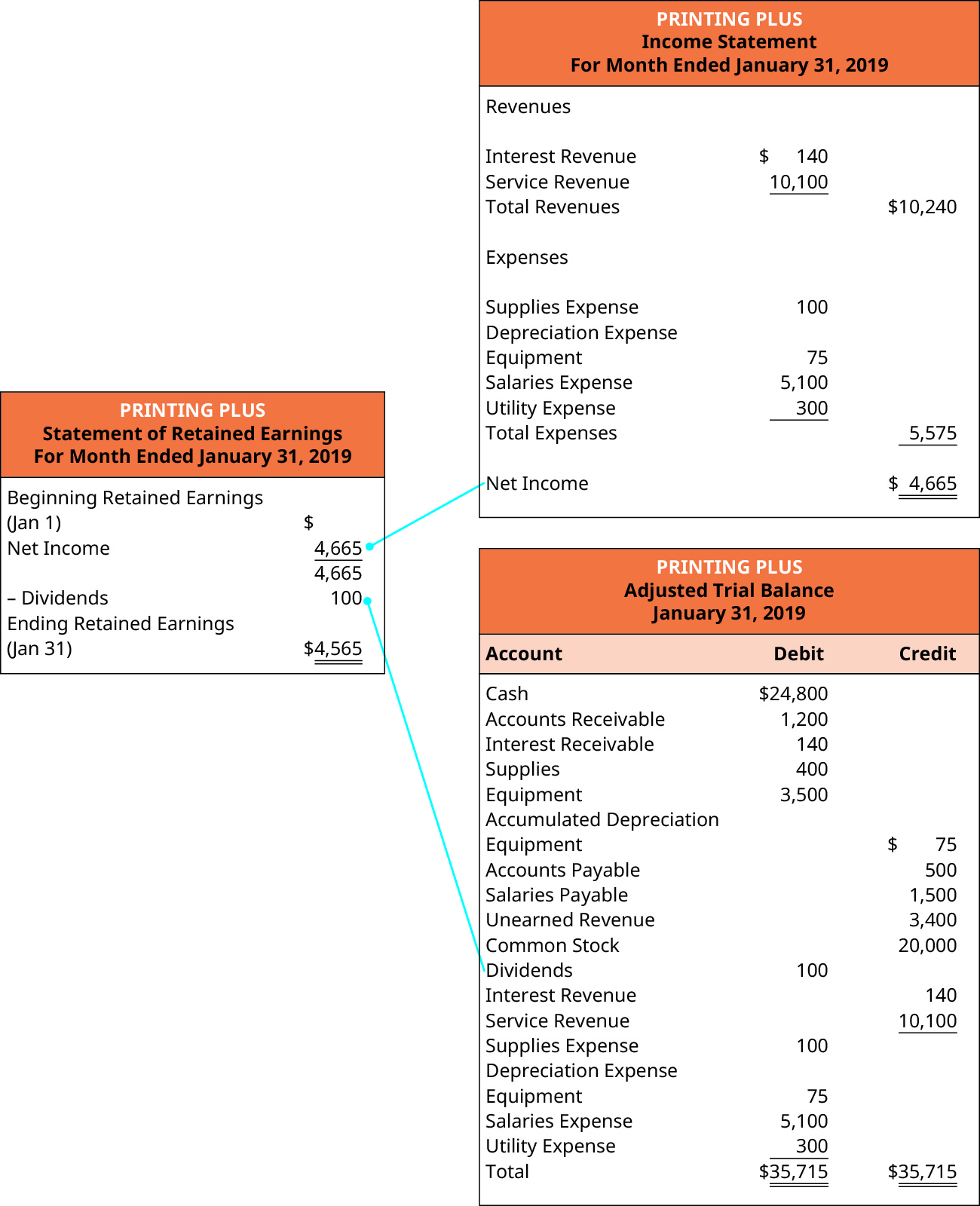

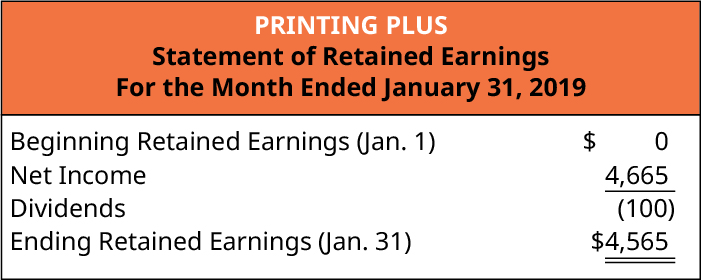

Argument of Retained Earnings

The statement of retained earnings (which is often a component of the statement of stockholders' equity) shows how the equity (or value) of the organization has changed over a period of time. The statement of retained earnings is prepared second to determine the ending retained earnings residuum for the period. The statement of retained earnings is prepared earlier the residuum canvas because the ending retained earnings amount is a required element of the balance canvas. The following is the Statement of Retained Earnings for Printing Plus.

Net income information is taken from the income statement, and dividends information is taken from the adjusted trial residue as follows.

The statement of retained earnings ever leads with start retained earnings. Commencement retained earnings deport over from the previous period's ending retained earnings balance. Since this is the first month of business for Printing Plus, there is no kickoff retained earnings balance. Discover the net income of $4,665 from the income statement is carried over to the statement of retained earnings. Dividends are taken away from the sum of outset retained earnings and net income to become the catastrophe retained earnings remainder of $4,565 for Jan. This catastrophe retained earnings balance is transferred to the balance sheet.

Concepts Statements give the Financial Accounting Standards Board (FASB) a guide to creating accounting principles and consider the limitations of financial statement reporting. See the FASB's "Concepts Statements" page to learn more.

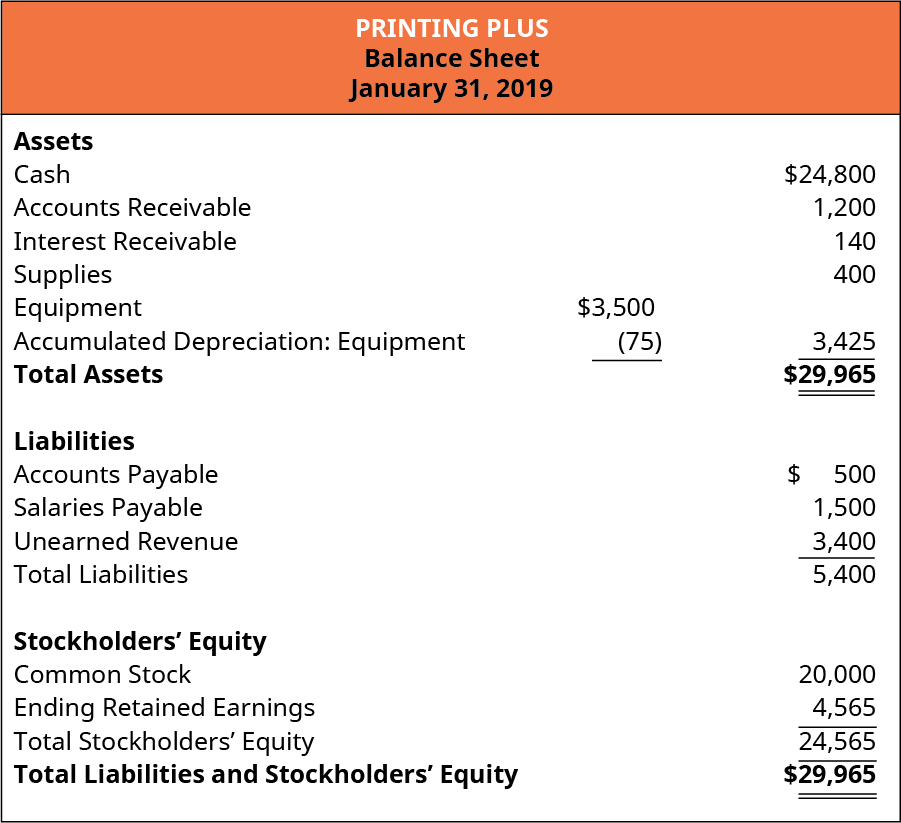

Balance Sail

The balance sheet is the tertiary statement prepared after the argument of retained earnings and lists what the arrangement owns (assets), what it owes (liabilities), and what the shareholders control (equity) on a specific appointment. Remember that the balance canvas represents the accounting equation, where assets equal liabilities plus stockholders' equity. The following is the Remainder Sheet for Printing Plus.

Catastrophe retained earnings information is taken from the statement of retained earnings, and asset, liability, and common stock data is taken from the adjusted trial balance equally follows.

Looking at the nugget section of the balance sheet, Accumulated Depreciation–Equipment is included as a contra asset account to equipment. The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the volume value of equipment ($3,425). The accounting equation is balanced, as shown on the balance sheet, because full assets equal $29,965 as practise the total liabilities and stockholders' equity.

There is a worksheet arroyo a company may employ to make certain end-of-period adjustments translate to the right financial statements.

Fiscal Statements

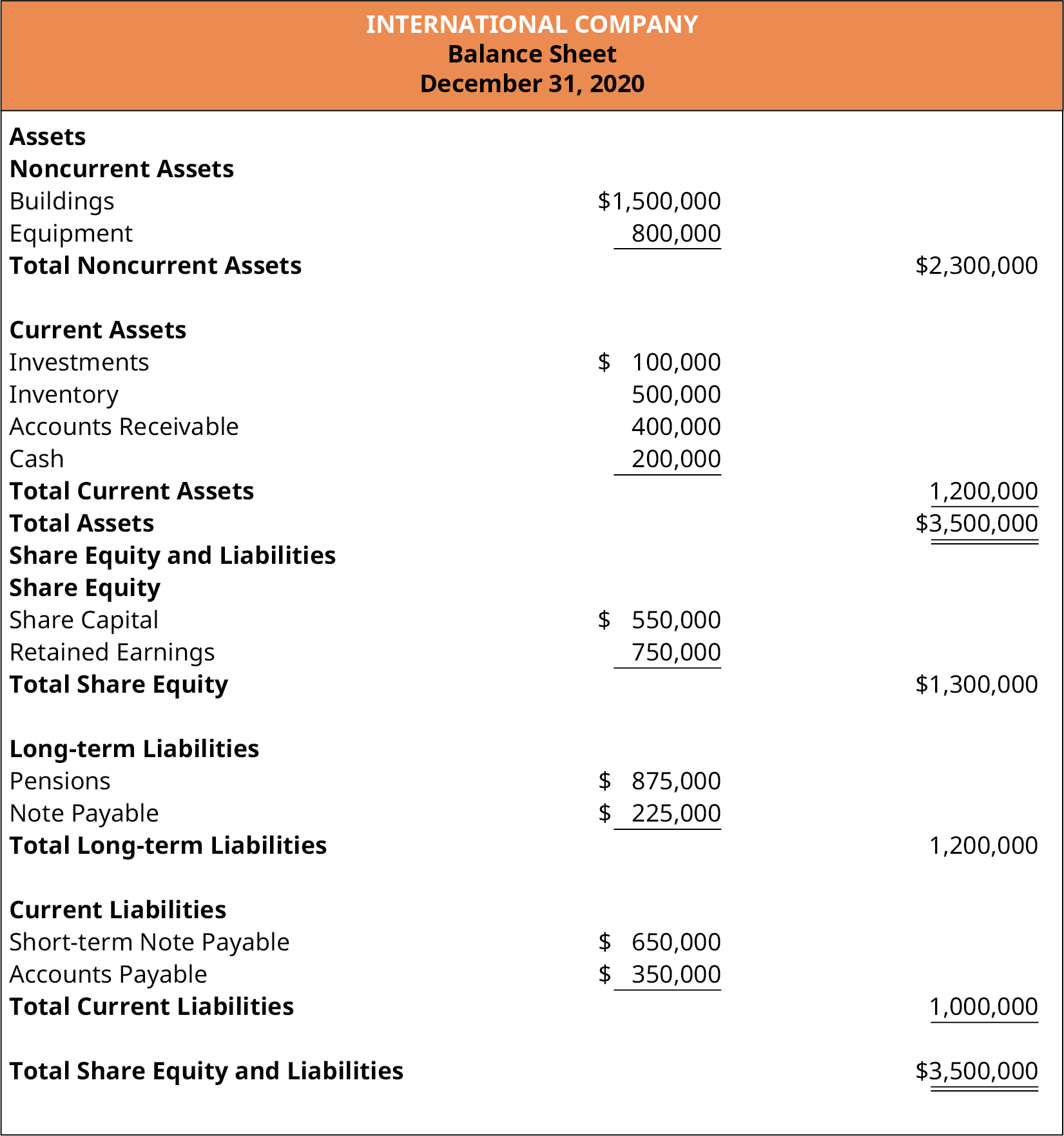

Both U.s.-based companies and those headquartered in other countries produce the same primary fiscal statements—Income Statement, Balance Sheet, and Argument of Cash Flows. The presentation of these 3 primary financial statements is largely similar with respect to what should be reported under Us GAAP and IFRS, simply some interesting differences can arise, peculiarly when presenting the Balance Sheet.

While both United states of america GAAP and IFRS crave the same minimum elements that must exist reported on the Income Statement, such every bit revenues, expenses, taxes, and net income, to name a few, publicly traded companies in the United states take further requirements placed past the SEC on the reporting of fiscal statements. For example, IFRS-based financial statements are only required to report the current period of information and the data for the prior menstruum. U.s. GAAP has no requirement for reporting prior periods, but the SEC requires that companies present one prior catamenia for the Balance Sheet and three prior periods for the Income Statement. Nether both IFRS and US GAAP, companies can report more than the minimum requirements.

Presentation differences are well-nigh noticeable between the two forms of GAAP in the Balance Sheet. Under Usa GAAP there is no specific requirement on how accounts should be presented. All the same, the SEC requires that companies present their Residue Canvass data in liquidity lodge, which means current avails listed first with cash being the first account presented, as it is a company'southward most liquid account. Liquidity refers to how hands an item tin can be converted to cash. IFRS requires that accounts exist classified into current and noncurrent categories for both avails and liabilities, but no specific presentation format is required. Thus, for US companies, the first category always seen on a Residuum Sheet is Current Assets, and the start account residue reported is cash. This is not always the instance under IFRS. While many Balance Sheets of international companies will be presented in the aforementioned fashion as those of a US company, the lack of a required format means that a company tin nowadays noncurrent avails first, followed by current assets. The accounts of a Balance Sail using IFRS might appear as shown here.

Review the almanac report of Stora Enso which is an international company that utilizes the illustrated format in presenting its Balance Canvass, also chosen the Statement of Financial Position. The Balance Sheet is establish on folio 31 of the study.

Some of the biggest differences that occur on financial statements prepared nether U.s. GAAP versus IFRS relate primarily to measurement or timing issues: in other words, how a transaction is valued and when it is recorded.

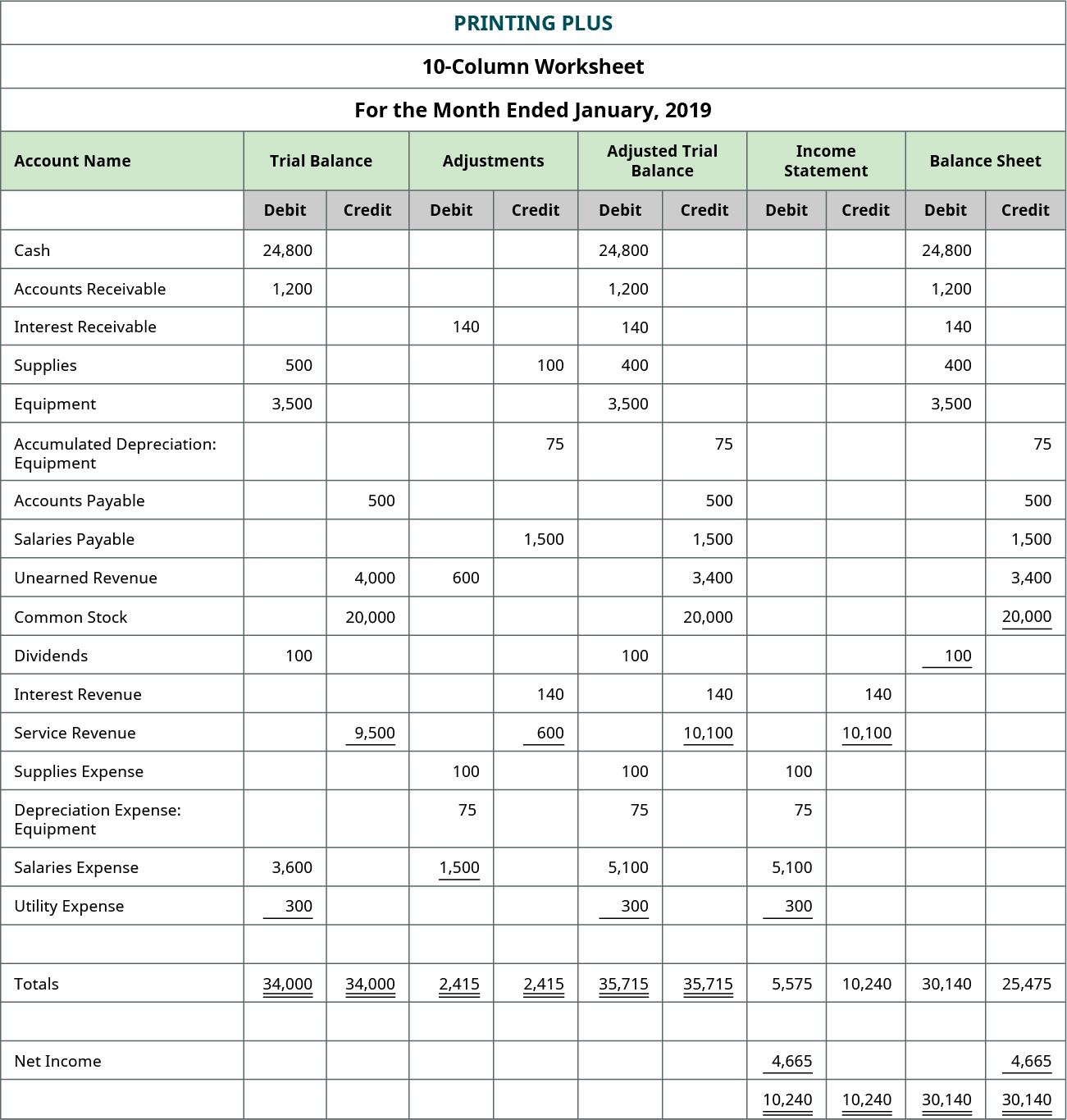

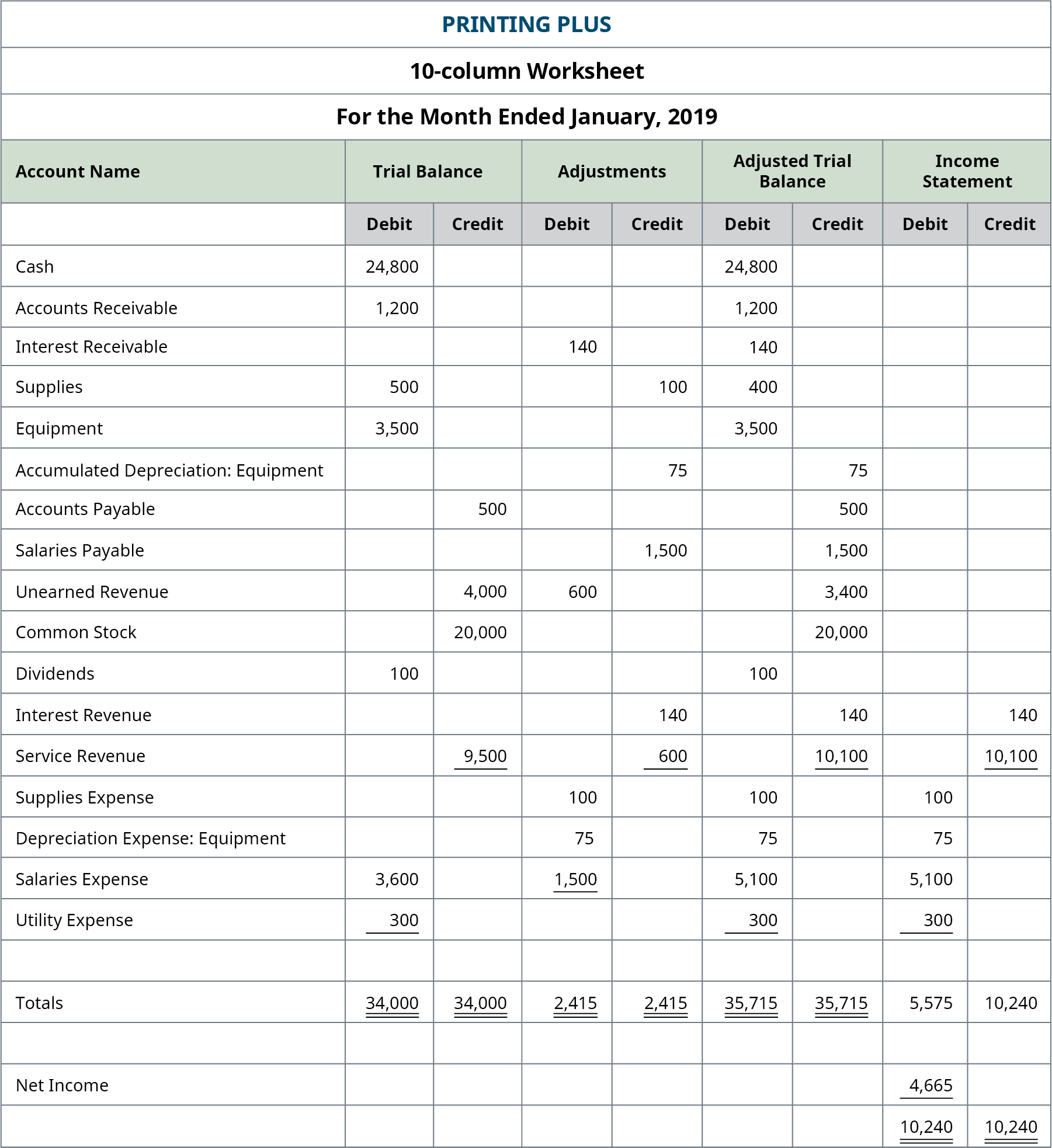

Ten-Column Worksheets

The 10-column worksheet is an all-in-one spreadsheet showing the transition of business relationship data from the trial balance through the financial statements. Accountants apply the 10-cavalcade worksheet to help calculate end-of-period adjustments. Using a x-column worksheet is an optional step companies may apply in their bookkeeping process.

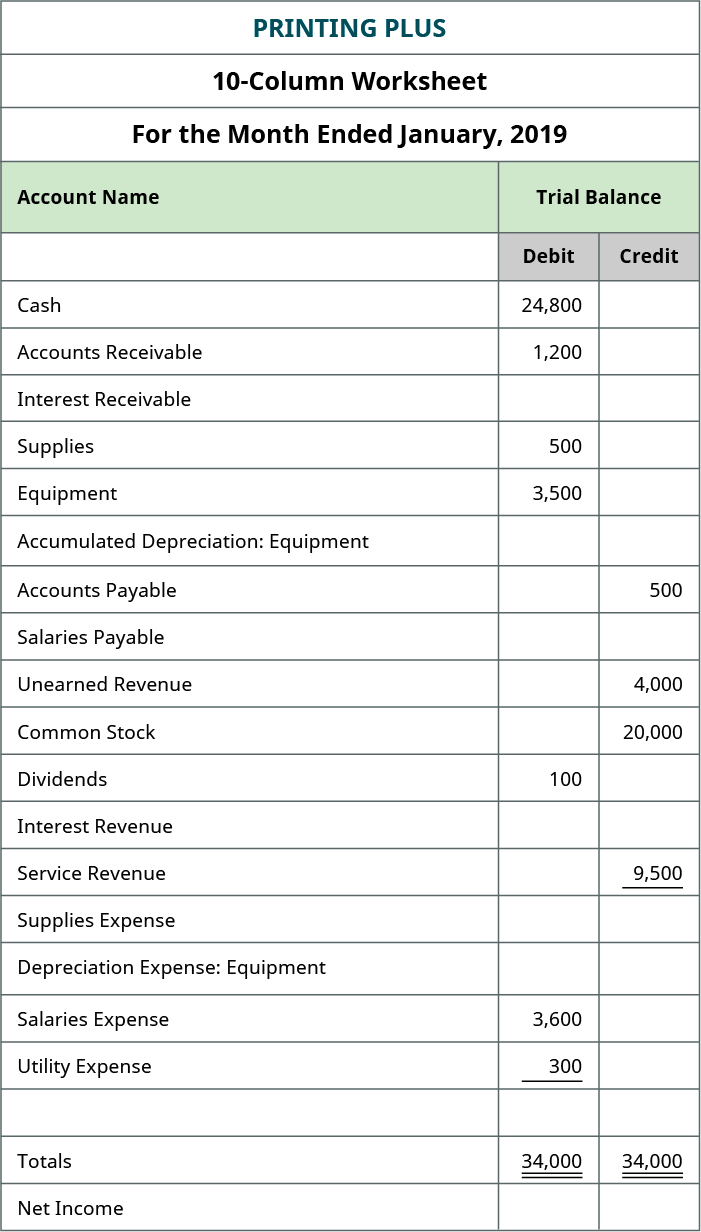

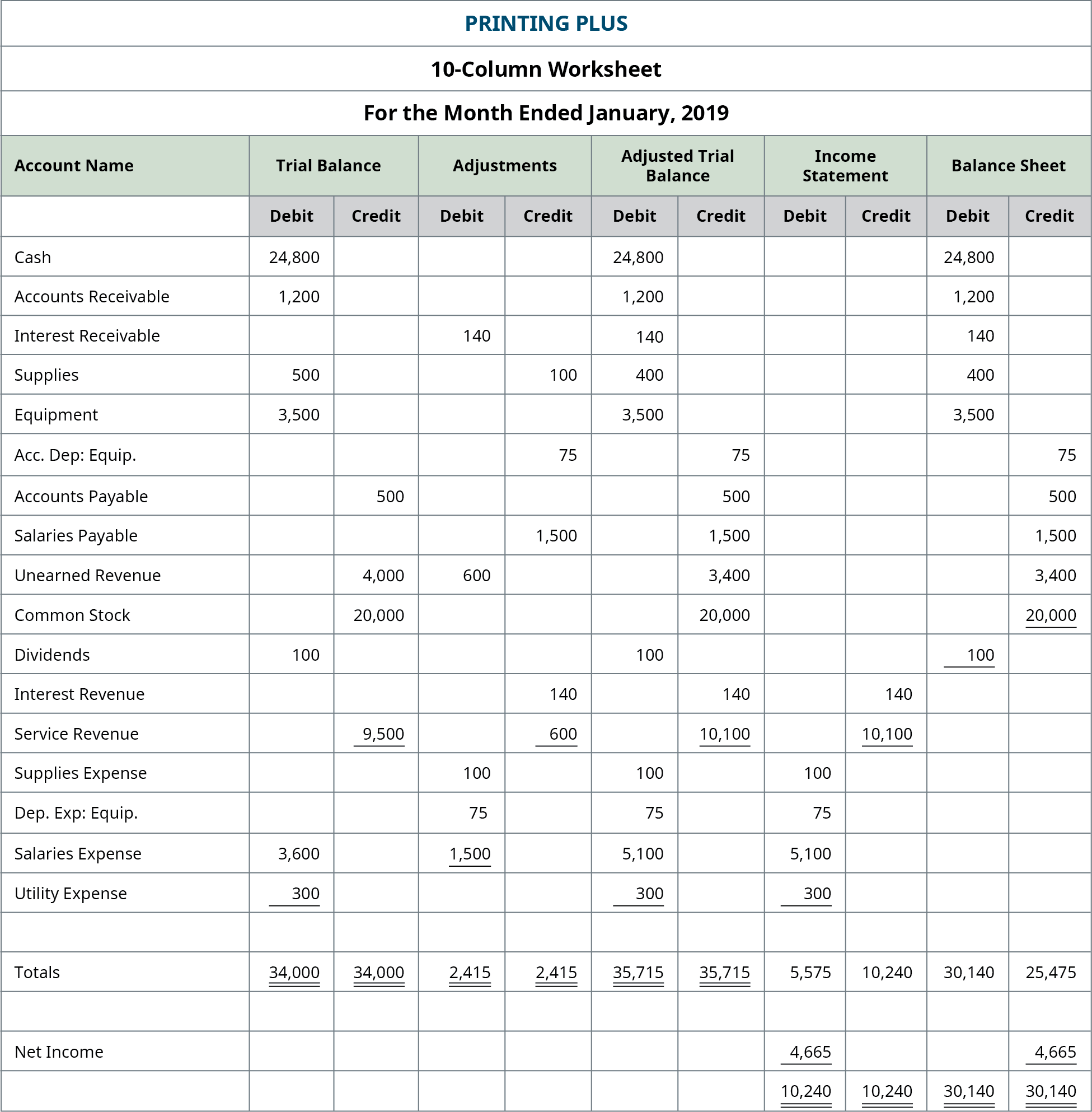

Here is a picture of a ten-column worksheet for Printing Plus.

In that location are five sets of columns, each set having a column for debit and credit, for a total of 10 columns. The 5 column sets are the trial residual, adjustments, adjusted trial balance, income argument, and the balance canvas. After a company posts its twenty-four hours-to-day journal entries, information technology can brainstorm transferring that data to the trial remainder columns of the ten-column worksheet.

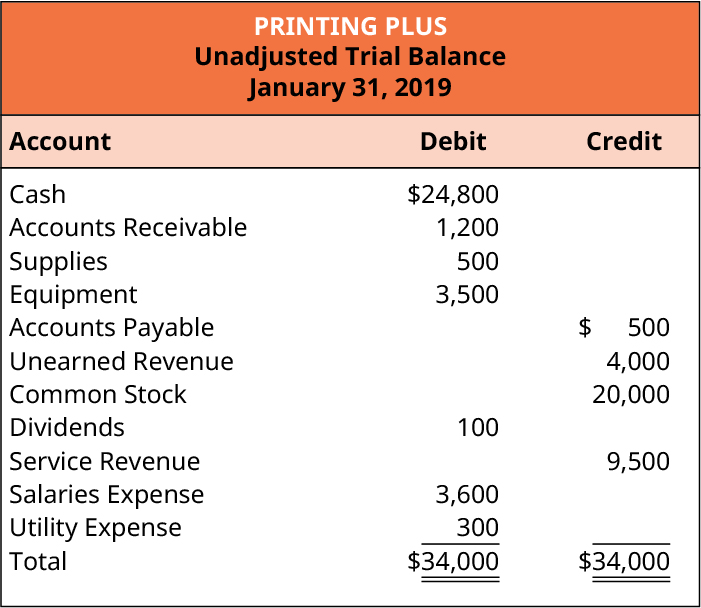

The trial balance information for Printing Plus is shown previously. Discover that the debit and credit columns both equal $34,000. If nosotros become back and look at the trial balance for Press Plus, we run across that the trial balance shows debits and credits equal to $34,000.

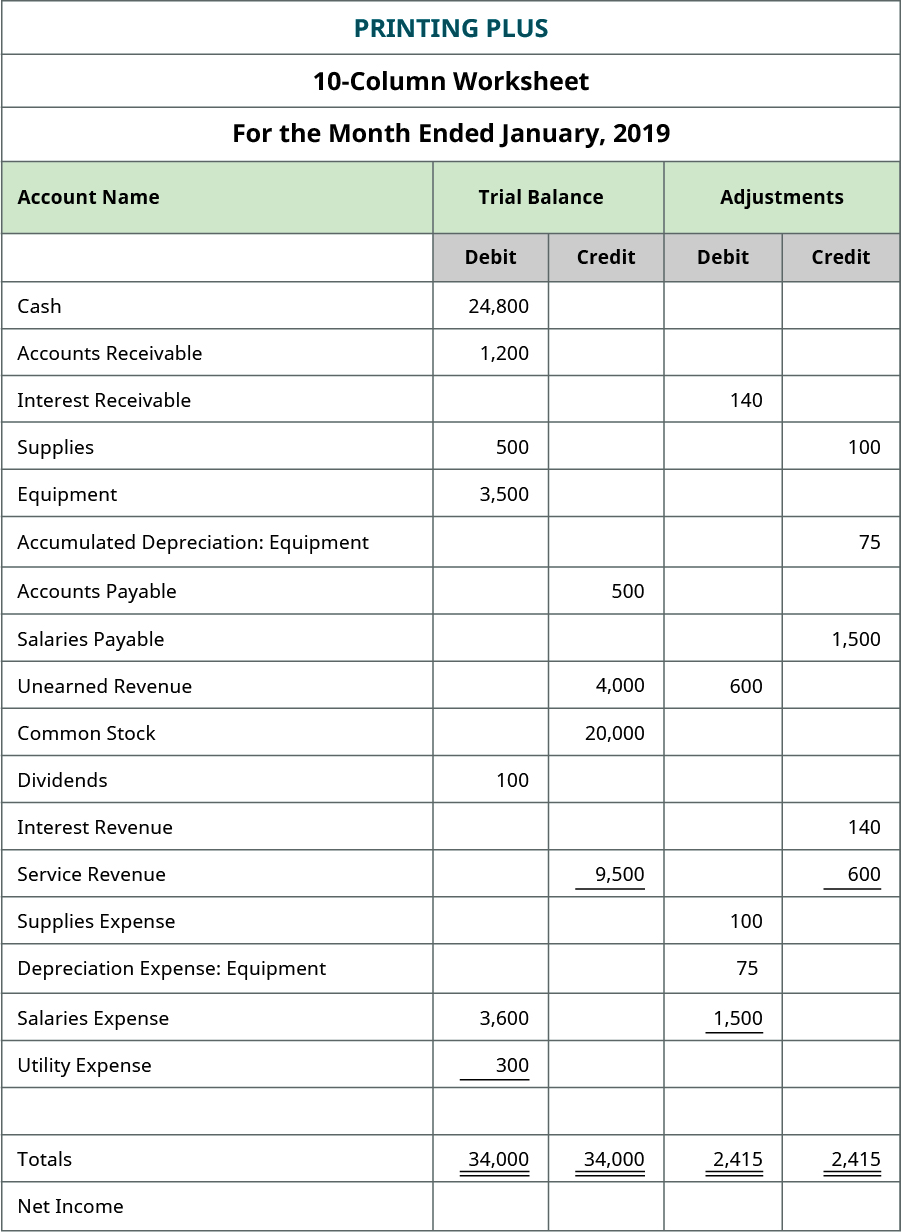

In one case the trial balance information is on the worksheet, the adjacent step is to fill in the adjusting data from the posted adjusted journal entries.

The adjustments total of $2,415 balances in the debit and credit columns.

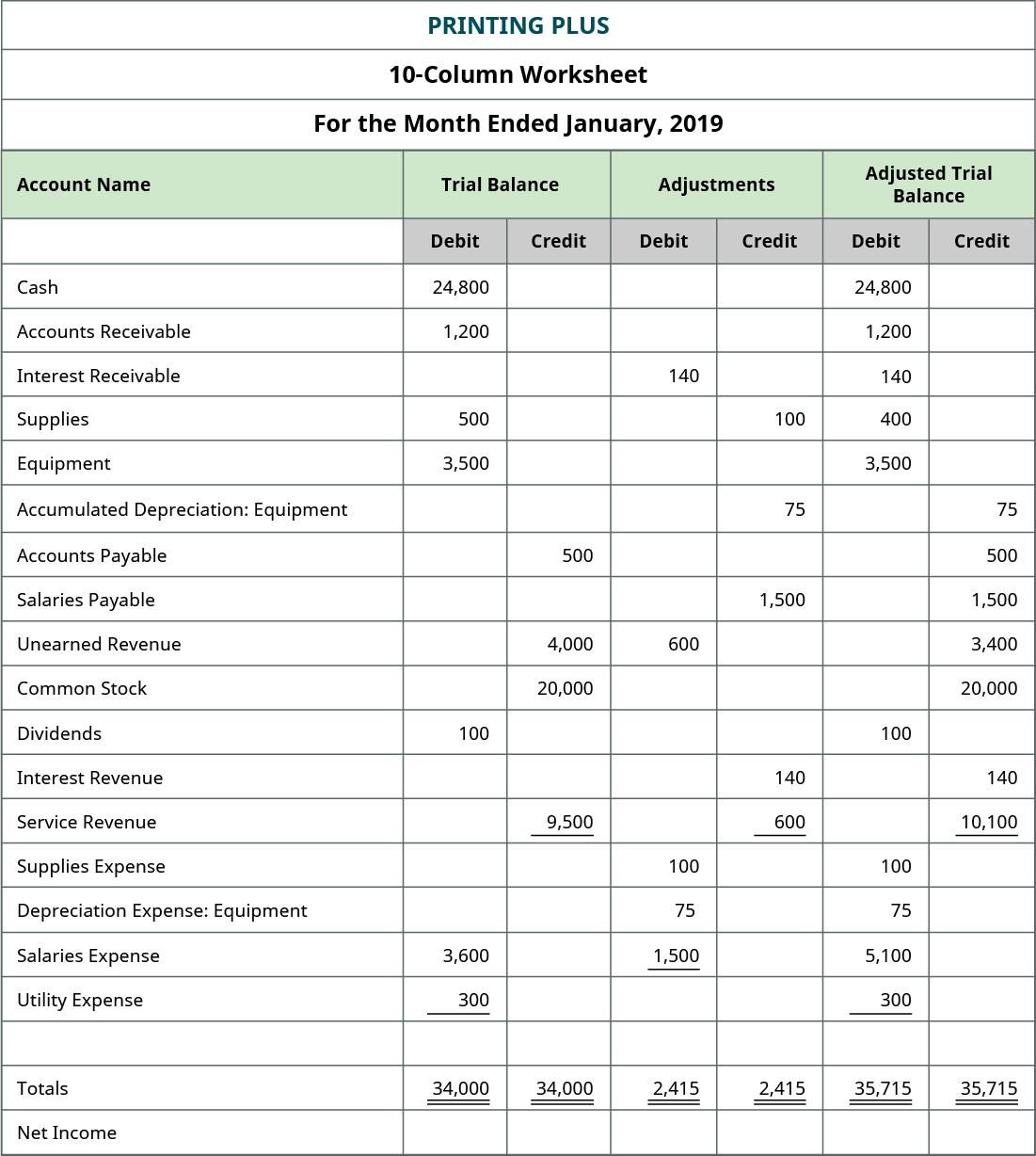

The adjacent step is to record information in the adjusted trial residue columns.

To get the numbers in these columns, y'all take the number in the trial balance column and add or decrease any number establish in the adjustment column. For example, Greenbacks shows an unadjusted rest of $24,800. In that location is no adjustment in the adjustment columns, then the Greenbacks balance from the unadjusted balance column is transferred over to the adjusted trial residual columns at $24,800. Interest Receivable did not exist in the trial balance information, so the balance in the adjustment column of $140 is transferred over to the adjusted trial balance column.

Unearned revenue had a credit balance of $4,000 in the trial balance column, and a debit aligning of $600 in the adjustment column. Remember that adding debits and credits is like calculation positive and negative numbers. This means the $600 debit is subtracted from the $four,000 credit to become a credit balance of $3,400 that is translated to the adapted trial residuum column.

Service Revenue had a $ix,500 credit residue in the trial balance cavalcade, and a $600 credit residue in the Adjustments cavalcade. To get the $10,100 credit balance in the adapted trial balance column requires adding together both credits in the trial residual and adjustment columns (9,500 + 600). You volition do the same process for all accounts. Once all accounts have balances in the adapted trial residue columns, add the debits and credits to make sure they are equal. In the case of Printing Plus, the balances equal $35,715. If you check the adjusted trial balance for Printing Plus, you will see the aforementioned equal remainder is present.

Side by side you lot will take all of the figures in the adjusted trial balance columns and carry them over to either the income statement columns or the remainder sheet columns.

Income Statement and Remainder Sheet

Take a couple of minutes and fill in the income statement and balance sheet columns. Total them when you are washed. Do non panic when they do not balance. They volition not balance at this time.

Solution

Looking at the income argument columns, we meet that all revenue and expense accounts are listed in either the debit or credit column. This is a reminder that the income statement itself does not organize information into debits and credits, simply we do use this presentation on a 10-column worksheet.

Yous will notice that when debit and credit income statement columns are totaled, the balances are not the aforementioned. The debit remainder equals $v,575, and the credit residuum equals $10,240. Why exercise they non balance?

If the debit and credit columns equal each other, it means the expenses equal the revenues. This would happen if a company broke even, significant the company did not make or lose any money. If there is a difference betwixt the two numbers, that difference is the amount of net income, or net loss, the visitor has earned.

In the Printing Plus case, the credit side is the higher figure at $10,240. The credit side represents revenues. This means revenues exceed expenses, thus giving the company a net income. If the debit column were larger, this would hateful the expenses were larger than revenues, leading to a net loss. You desire to summate the internet income and enter information technology onto the worksheet. The $4,665 internet income is plant by taking the credit of $10,240 and subtracting the debit of $five,575. When inbound internet income, it should be written in the cavalcade with the lower total. In this case, that would exist the debit side. Yous so add together the $5,575 and $4,665 to get a total of $ten,240. This balances the two columns for the income statement. If yous review the income statement, you see that net income is in fact $four,665.

We at present consider the last two columns for the balance sheet. In these columns we record all asset, liability, and equity accounts.

When adding the total debits and credits, yous discover they do not balance. The debit column equals $xxx,140, and the credit column equals $25,475. How do we get the columns to balance?

Treat the income statement and balance sheet columns like a double-entry accounting system, where if you have a debit on the income statement side, you must have a credit equaling the same amount on the credit side. In this case we added a debit of $4,665 to the income statement column. This means nosotros must add a credit of $4,665 to the balance sheet cavalcade. Once we add the $iv,665 to the credit side of the balance sheet column, the 2 columns equal $30,140.

You may discover that dividends are included in our x-column worksheet balance sheet columns even though this account is not included on a balance sail. So why is information technology included here? There is really a very proficient reason nosotros put dividends in the residual sheet columns.

When you fix a residuum canvass, you must first accept the most updated retained earnings balance. To get that remainder, you take the beginning retained earnings residual + internet income – dividends. If you look at the worksheet for Press Plus, you volition find there is no retained earnings business relationship. That is because they just started concern this calendar month and accept no beginning retained earnings remainder.

If you expect in the rest sheet columns, we do have the new, up-to-date retained earnings, but it is spread out through ii numbers. You take the dividends remainder of $100 and net income of $iv,665. If you combine these two individual numbers ($4,665 – $100), you volition have your updated retained earnings rest of $4,565, as seen on the statement of retained earnings.

You will not encounter a similarity between the 10-column worksheet and the residual sheet, because the 10-column worksheet is categorizing all accounts past the blazon of balance they have, debit or credit. This leads to a final balance of $thirty,140.

The residuum sheet is classifying the accounts by blazon of accounts, assets and contra avails, liabilities, and equity. This leads to a last residue of $29,965. Even though they are the same numbers in the accounts, the totals on the worksheet and the totals on the residuum canvass will be different because of the unlike presentation methods.

Publicly traded companies release their financial statements quarterly for open viewing past the full general public, which can ordinarily be viewed on their websites. I such company is Alphabet, Inc. (trade name Google). Take a await at Alphabet'southward quarter ended March 31, 2018, financial statements from the SEC Form ten-Q.

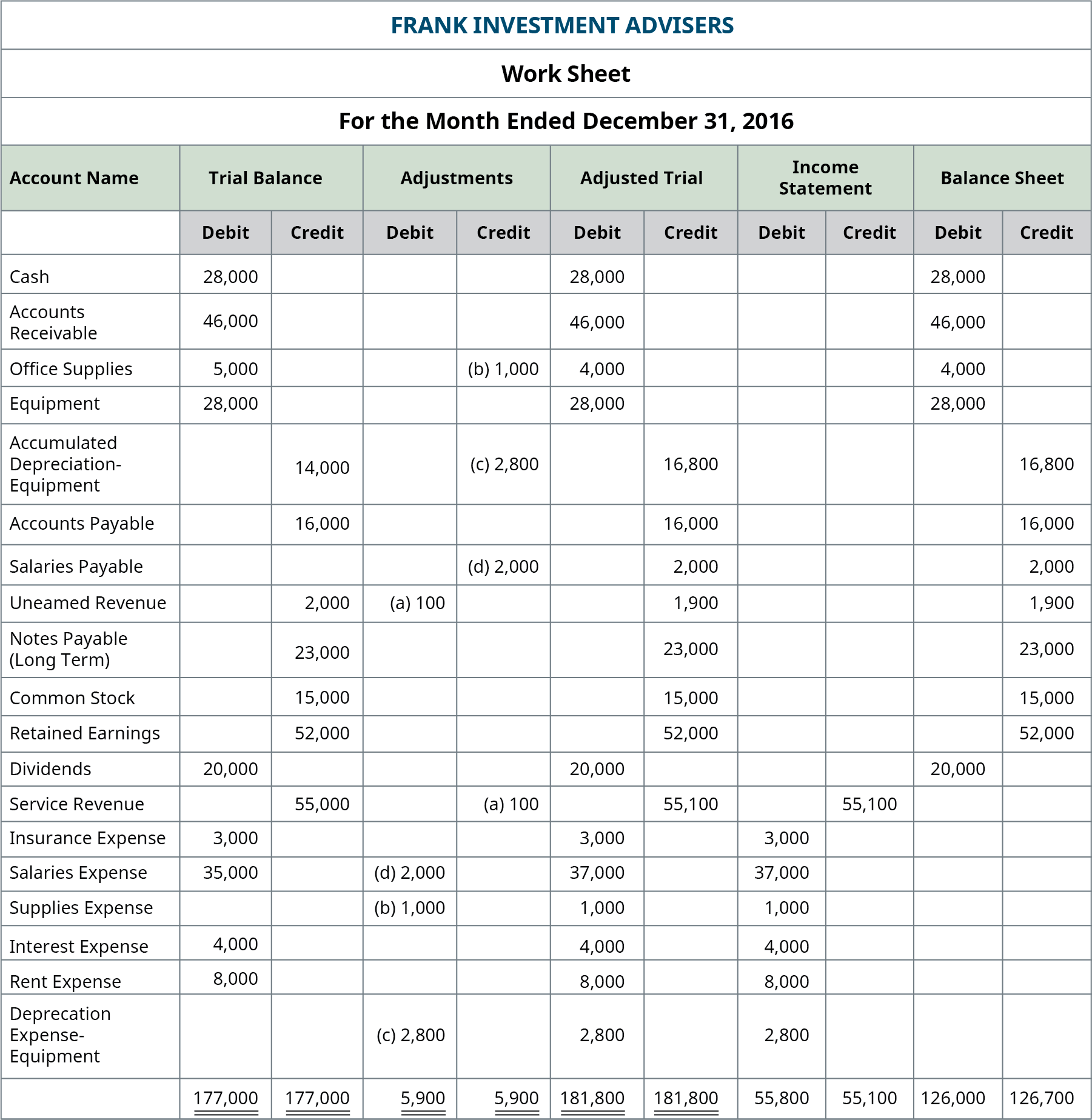

Frank'southward Internet Income and Loss

What amount of internet income/loss does Frank have?

Solution

In Completing the Accounting Bike, we continue our word of the accounting cycle, completing the last steps of journalizing and posting closing entries and preparing a post-closing trial balance.

Key Concepts and Summary

- Income Statement: The income statement shows the cyberspace income or loss as a result of revenue and expense activities occurring in a period.

- Statement of Retained Earnings: The argument of retained earnings shows the effects of net income (loss) and dividends on the earnings the company maintains.

- Balance Canvas: The balance sheet visually represents the accounting equation, showing that assets remainder with liabilities and equity.

- 10-column worksheet: The 10-column worksheet organizes data from the trial balance all the way through the financial statements.

Multiple Option

(Effigy)On which financial statement would the Supplies account appear?

- Balance Sheet

- Income Argument

- Retained Earnings Statement

- Statement of Cash Flows

(Figure)On which fiscal statement would the Dividends account announced?

- Rest Canvass

- Income Argument

- Retained Earnings Statement

- Argument of Cash Flows

C

(Figure)On which financial statement would the Accumulated Depreciation account appear?

- Residuum Sail

- Income Argument

- Retained Earnings Statement

- Statement of Greenbacks Flows

(Figure)On which 2 fiscal statements would the Retained Earnings account appear?

- Balance Sheet

- Income Statement

- Retained Earnings Statement

- Statement of Greenbacks Flows

A and C

Questions

(Figure)Indicate on which financial statement the following accounts (from the adjusted trial residuum) would announced: (A) Sales Revenue; (B) Unearned Hire Revenue; (C) Prepaid Advertizement; (D) Advertizement Expense; (E) Dividends; (F) Cash.

(A) Income Argument; (B) Balance Sheet; (C) Balance Canvass; (D) Income Argument; (East) Retained Earnings Argument; (F) Rest Sheet

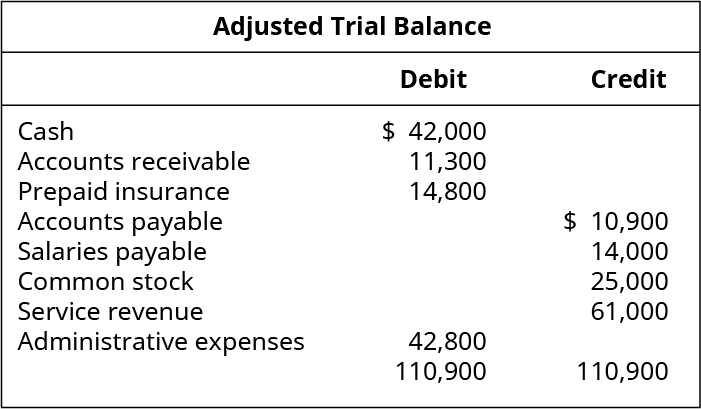

Exercise Ready A

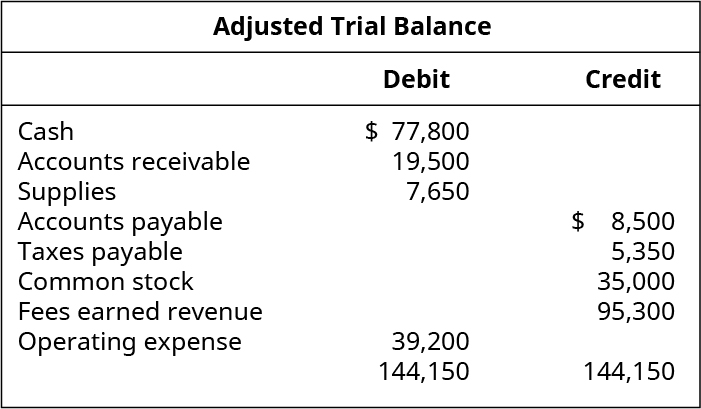

(Figure)From the post-obit Company A adapted trial balance, ready uncomplicated financial statements, as follows:

- Income Statement

- Retained Earnings Statement

- Rest Sheet

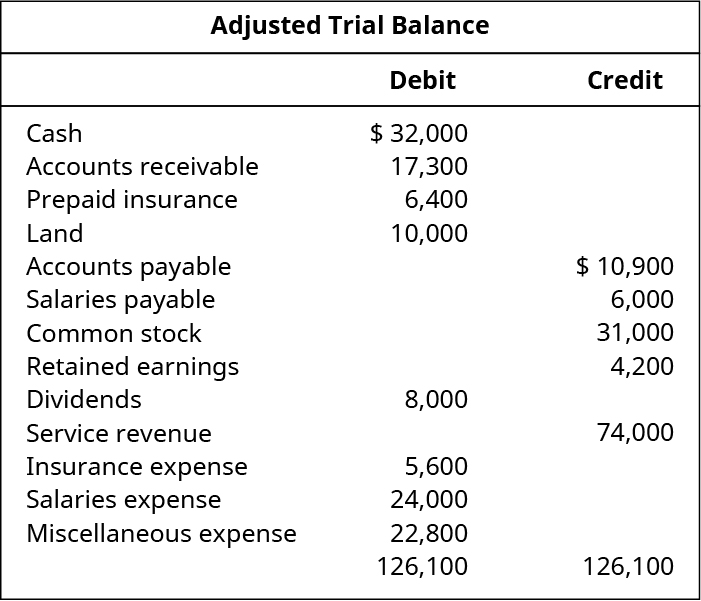

Exercise Set B

(Figure)From the post-obit Company B adjusted trial balance, fix simple financial statements, equally follows:

- Income Argument

- Retained Earnings Statement

- Residual Sheet

Problem Fix A

(Figure)Using the following Company W data, prepare a Retained Earnings Statement.

- Retained earnings rest January 1, 2019, $43,500

- Cyberspace income for year 2019, $55,289

- Dividends declared and paid for twelvemonth 2019, $18,000

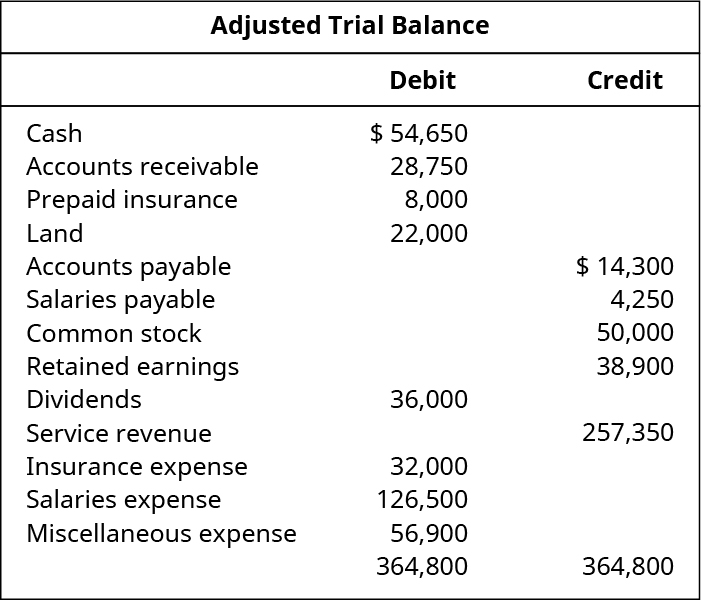

(Figure)From the following Company Y adjusted trial remainder, prepare simple financial statements, as follows:

- Income Statement

- Retained Earnings Statement

- Residual Sheet

Problem Set B

(Figure)Using the following Company X data, prepare a Retained Earnings Statement:

- Retained earnings balance January 1, 2019, $121,500

- Net income for yr 2019, $145,800

- Dividends alleged and paid for year 2019, $53,000

(Effigy)From the following Company Z adjusted trial rest, prepare simple fiscal statements, as follows:

- Income Statement

- Retained Earnings Argument

- Balance Sheet

Thought Provokers

(Figure)Search the SEC website (https://www.sec.gov/edgar/searchedgar/companysearch.html) and locate the latest Form ten-K for a company you would similar to clarify. Submit a short memo:

- State the name and ticker symbol of the company you lot have chosen.

- Review the company's end-of-period Balance Sheet, Income Statement, and Argument of Retained Earnings.

- Reconstruct an adapted trial balance for the company, from the data presented in the 3 specified financial statements.

- Provide the spider web link to the company's Class 10-K, to let accurate verification of your answers.

Footnotes

- one James Jaillet. "Celadon nether Criminal Investigation over Fiscal Statements." Commercial Carrier Periodical. July 25, 2018. https://www.ccjdigital.com/200520-2/

Glossary

- 10-column worksheet

- all-in-one spreadsheet showing the transition of account information from the trial balance through the financial statements

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/prepare-financial-statements-using-the-adjusted-trial-balance/

0 Response to "Review the Following Statements and Determine Which Are Correct Regarding an Adjusted Trial Balance"

Postar um comentário